Minutes from the July Federal Reserve meeting indicate a willingness to reduce asset purchases before 2021 ends.

Tapering off on asset purchases will eventually impact the T-Note yields, and higher yields on Treasurys mean higher rates on mortgages.

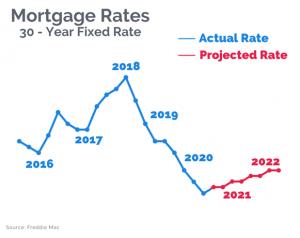

After insanely low mortgage rates during the pandemic, rates continue to stay low… for now.

| Get a Quote in 3 Mins! |

While rates continue to stay at historic lows (under 3%), we must prepare for higher rate environment.

The looming possibility of the Federal Reserve tapering off on the economy makes now an ideal time to wrap up a refinance, borrow cash from your equity, or purchase a home before rates start climbing up.

Let us crunch some numbers, see if it makes sense for you:

✅ Lock a low rate

✅ Save money overtime

✅ Pay your mortgage down

✅ Lower your monthly payment

✅ Cash some money out

Let us Crunch Numbers

Call 800 816 5626 now or chat with a Home Loan Expert by requesting a quick quote:

- Lowest rates in 50+ years

- Lower mortgage payment

- Increase purchasing power

- Stop wasting money on rent

- Pay off your mortgage earlier

| Get a Quote in 3 Mins! |