2021 has definitely been a great year for real estate, even if you weren’t a buyer or seller chances are you heard about the crazy hot market. After this year, you may be considering selling or buying yourself now (maybe even both!) next year. If so, here’s what to expect.

Want to buy before the end of the year?

On November 10th the 30-year fixed mortgage rate was announced as 2.98%, the lowest it’s been since September 23rd. If you’re in the market to buy, it’s a great time as rates are clearly not skyrocketing quite yet. Wondering if these low rates will last going into the new year? Many real estate experts have been watching the market and are now sharing their predictions.

#1. Big cities could surge again

Spears Group founder and real estate agent Jonathan Spears of Santa Rosa Beach, FL believes that market gains will continue across the US next year. Especially as people are becoming comfortable with moving back to large cities, with markets having huge surges in the West Coast, Northeast, and Southeast. He foresees large growth in the real estate market in the US in 2022.

“Despite some market prognosticators forecasting increases in market values upwards of 15%, because the market experienced an increase of over 30% in the previous year, it may actually seem as though real estate markets have slowed,” he said. “Because of low inventory, we won’t see as high of rates of absorption simply because the inventory is not there.”

#2. The rate at which home values are appreciating will slow down

Andrina Valdes points to statistics from Fannie Mae and National Association of Realtors, to back her predictions for home prices. Fannie Mae is predicting a 7.4% home appreciation for 2022, as for the National Association of Realtors, they predicts 2.8% appreciation for existing homes and 4.4% appreciate for new homes. Valdes, the COO of Cornerstone Home Lending, Inc shared “While home values are not expected to depreciate, the rate at which home values are appreciating is expected to slow down,”

#3. Mortgage rates may rise… slowly but surely

Valdes also believes that mortgage rates will rise going into the new year, but still remain historically low. This is great news for buyers, but also mean that buyer demand will most likely stay high as well. “The market is likely to cool compared to 2021, but it will still be active,” she said. “It may still be a seller’s market in many areas, but there’s likely to be more opportunities and wiggle room for homebuyers.”

It will be a great time for those looking to purchase a home, to buy. “A ‘priced out’ buyer should be able to find many more options,” she said. “Experts also reinforce that 2022’s housing market is not at all likely to crash — the conditions we’re seeing are nothing like those that led up to the crisis of 2008.”

The chief economist at Realtor.com, Danielle Hale also believes that buyers will be able to get more for their money in 2022. “Home asking prices have decelerated in the second half of 2021, with median listing price growth slipping from a peak 17.2% in April to just 8.6% in October,” she said. “Sales prices have slowed somewhat, but not yet as rapidly.” She thinks that this is likely to change, “With prices near all-time highs and mortgage rates expected to rise, we expect this slowdown in prices to continue,” she shared.

Jason Gelios, a realtor in Southeast Michigan said the 2022 market will be favoring home buyers, stabilizing prices. The prices will stay strong though which will benefit both the seller and buyer in transactions. “Many first-time homebuyers who weren’t able to compete with stronger homebuyers during the hyperactive sellers’ market will have a chance to bid on homes in 2022,” he said. “However, buyers should expect to pay close to the asking price, as the housing inventory will more than likely be less than where it should be.”

#4. Inventory will probably stay low

A low supply of homes for sale will still continue to be an issue next year, claims Bill Samuel, a residential real estate developer and owner of Chicago-based home-buying company Blue Ladder Development.

“Expect a very competitive market through 2022, with multiple offers on most of the properties you are interested in,” said Samuel, who is also a licensed real estate broker. Available inventory is still low, but it is slightly higher than it was at the start of 2021. While the market may not be as insane as the last several months, it is still much more competitive than before COVID started.”

The housing market has been improved by the pandemic due to less homes being for sale and more buyers looking with low interest rates. “Foreclosures and evictions will resume their normal course starting at the end of 2021,” he said. “So we will likely see an increase in the supply of homes for sale.” Although availability may rise, it will still be a lot lower than before the pandemic.

“In my opinion, the market will continue to remain strong throughout 2022, with continued low supply,” he said. “However, I don’t expect demand for housing and the overall market to be quite as hectic as 2021.”

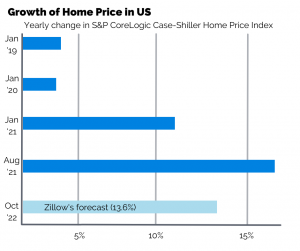

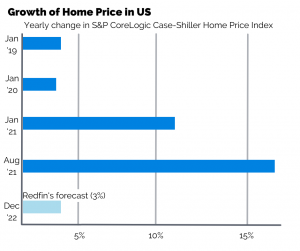

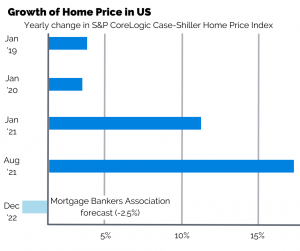

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index is a composite of single-family home price indices for the nine U.S. Census divisions and is calculated monthly. It is included in the S&P CoreLogic Case-Shiller Home Price Index Series which seeks to measure changes in the total value of all existing single-family housing stock.

#5. Housing Market will stay HOT during cold months

The housing market is losing some steam as it is reaching the seasonal cooling period. Homebuyers are also waiting out expensive pricing, October dropped to 60.3% of sales with bidding wars compared to the historic high of 74.5% in April. Of course, there’s always the chance that the Federal Reserve will raise rates to try and smooth out inflation.

Here are three housing market predictions, that may not put buyer or sellers at ease due to their inconsistencies. Some forecasts predict price growth skyrocketing, as others foresee appreciation slowing down more than it has in a decade.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index is a composite of single-family home price indices for the nine U.S. Census divisions and is calculated monthly. It is included in the S&P CoreLogic Case-Shiller Home Price Index Series which seeks to measure changes in the total value of all existing single-family housing stock.

Zillow and Goldman Sachs are on the higher end, Zillow believing that home prices will rise 13.6% from October 2021 to October 2022. Goldman Sachs guesses a 16% increase between October 2021 and December 2022. The largest 12 month increase previously recorded was 14.1% leading up to the 2008 housing crash. Researchers at these two companies see priced out buyers falling further behind next year.

Zillow nor Goldman Sachs believes that the wave of first-time homebuyers will be letting up. We are in the middle of the five-year period where the largest millennial birth years are reaching the typical first-time home buying age of 30. The two companies don’t see enough homes being sold to make demand.

Over the past year, home price average has had 19.9% growth, four times the average 4.6% per year since 1980. Seven companies predict price growth will fall in 2022 back to the historical average. These companies include Fannie Mae and Freddie Mac, predicting growth to be 7.9% and 7%. A bit higher than the past, but not as high as of recent. Redfin and CoreLogic believe the 12-month price growth will be 3% and 1.9%.

These companies are predicting that price growth will be lower due to rising mortgage rates. By the end of 2022, Fannie Mae projects the rate to be 3.4% from the current 3.1%. Redfin sees even higher at 3.6%. Another potential aspect, if corporate America starts to bring employees back into the office. This could lead to less buyers in the second home market and exurbs if there are less work from home situations.

The Mortgage Bankers Association, is seeing a different story, that existing home prices will drop 2.5%. They believe that the 30-year fixed mortgage rate will reach 4% by the end of 2022. Even if the Mortgage Bankers Association’s price drop seems daunting, but it still won’t come close to a housing crash, prices still being 20% above pre-pandemic levels.

Believe what you will, but if your New Years Resolution is to purchase a new home, it could be time to start thinking of getting pre-approved.

Get pre-approved for the new year!

Sources: Yahoo News, Fortune