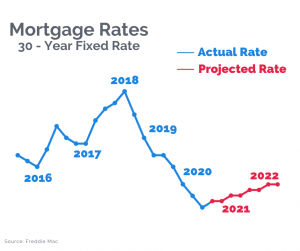

Are you going to make 2021 the year you finally buy your first home? With mortgage rates remaining at historic lows, now is a great time to make that dream of homeownership a reality.

But what do you need to know about buying a home in 2021? Are there any insider tips that can help you along the way? What can you be doing right now to help prepare yourself for becoming a first time home buyer this year? Here at SnapFi we are here to help!

If you are trying to figure out where to start as a first time homebuyer buying a home in 2021, you should know that the entire process is not quick and there is much to consider, but is one of the most amazing and rewarding experiences that can ever come from spending your money

What to Expect for the Housing Market in 2021

Every year the U.S housing market is different. While the economy expands and contracts, the housing market reacts, producing buyers and sellers markets. If you’re planning on buying a house in 2021, it’s important to understand what the market is doing now and how it’s expected to perform over the course of the year.

The housing market will remain strong through 2021 as the economy recovers from the pandemic-driven recession. In early 2021, homebuyers will remain undeterred by the pandemic, eager to take advantage of sub-3% mortgage rates while they last. Later in the year, the worst of the pandemic will hopefully be behind us, and as businesses reopen and daily activities become safer, a new batch of homebuyers and sellers will enter the housing market, making for the strongest year of home sales since 2006.

To help you get started, here are some amazing tips for becoming a homeowner in 2021.

1. Put together an experienced team.

Getting your offer accepted in the competitive 2021 housing market starts with forming an experienced team. The first step is to get in contact with SnapFi because we wont charge you extra fees and get’s your pre-approval locked in so you know YOUR numbers and budget. Then it’s time to go shopping with one of our realtor’s who will be an expert at negotiating on your behalf. Overall, having the right team on your side will prevent stress and give you a fun and exciting home buying experience.

2. Get pre-approved.

Consult a lender to review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for. A pre-approval letter provides an estimate of what you might be able to borrow and demonstrates to home sellers that you’re serious about buying. It also provides you with bargaining power which could give you an advantage over other buyers.

Click here to see if you’d qualify to buy now: http://homefinder.snapfi.com/

3. Define your homebuying goal.

Do this by asking yourself, “am I buying a home or investing in real estate?” Your primary residence is an investment in your lifestyle and family; it’s not an income-producing asset. Figure out what goal best suits you and the lifestyle you envision yourself living.

4. Check your credit score.

Before applying for a loan and certainly before ever making an offer on a house, you should know your credit score. Why is your credit score important? Well, it’s not only the difference between getting a low-interest rate on a home loan versus a high one, but it will also directly impact how much a bank or lender will loan you. There are several websites you can use to check your credit score, here are a few to consider: TransUnion, Equifax, Experian.

You can check your score as much as once a day without affecting your credit, also known as a soft inquiry. Hard inquiries are when financial institutions check your credit, typically when you’re applying for a loan or credit card. Hard inquiries will lower your score a few points, so just try to keep hard inquiries to a minimum.

5. Rebuild your credit if needed.

Your credit score was important when the economy was booming, now it’s crucial that you have a great credit score, and it is that much more important if the economy dips further. There is good news – record-low interest rates on mortgages, auto loans, and credit cards. So start rebuilding and ensure that your FICO is in tip-top shape to purchase the home of your dream’s. The SnapFi team is dedicated to getting your credit score back on track, so don’t worry, you won’t be doing this alone!

6. Determine how much you can afford. Whatever amount you are approved for is not the right way to think about what you can afford. Instead, think about the following:

- How much of a down payment do you have and is it 20% of the property value to avoid PMI (Primary Mortgage Insurance)?

- Can you afford the mortgage payment each month (including escrow)?

Usually, your approval limit is a lot higher than either what you can afford each month or what you can afford to put 20% down on.

Talk with one of our loan advisers here at SnapFi and we can discuss our downpayment program and how that might work for you!

7. Ensure you’re financially prepared.

Homebuyers need to be financially prepared for the commitment a home purchase brings. They need to understand the difference between the mortgage they are qualified for and what actually fits within their financial plan. I caution my clients not to over-extend their monthly budgets and to factor in the total cost of homeownership; not just principal and interest payments, but insurance and taxes as well.

8. Get your financial house in order.

A huge part of buying a home is just getting your financial house in order. Basically making sure you have recent statements for your bank accounts, copies of your tax filings, and other documents readily available. Everyone thinks that banks can pull up this information electronically, but the process is incredibly time consuming and should be done before you find your dream home.

9. Have your documentation reviewed upfront to avoid any last-minute surprises.

Connect with one of our mortgage advisers before starting the house shopping process and have your file fully reviewed with all documentation needed upfront. This will enable you to be competitive in the market, and avoid last-minute surprises or issues.

10. Maintain 100% open and honest communication with your mortgage adviser.

Tell your mortgage adviser everything in regards to employment, income, housing history, credit history, assets, everything – even if you don’t think it is pertinent or even if you think it will hurt your chances of becoming approved. Surprises in the underwriting process of buying a home are never a good thing and most likely could have been resolved and corrected had they been openly communicated.

11. Don’t change jobs or take out new loans.

Stability, employment, and income shows our advisers how much house you can afford and are important indicators for qualifying for a mortgage. So don’t change jobs or take out new loans while in the process of buying your new home.

12. Have a safety net.

If you don’t have any funds saved towards a down payment, consider waiting as you never know what unforeseen expenses you may encounter with a new home. Having a safety net will provide some financial security.

13. Get certified ahead of time.

With home inventory levels extremely low, positioning yourself to have the best chance of getting your offer accepted, is critical. Arguably, the most important component of this is ensuring that your loan application is fully underwritten prior to making any offer.

14. Submit an offer with a pre-approval letter.

When buying a house, make sure you submit an offer with a pre-approval letter from a mortgage adviser. This is very important because this signifies to sellers that you are a serious buyer who has done his/her homework.

15. Make a competitive offer.

In a competitive market, your offer needs to be competitive. Many advisers will offer a “platinum” pre-approval if you provide all your financial documents upfront so you can be approved pending appraisal and title. Our advisers will reach out to the listing agent when your offer is submitted.

16. Beware of your closing costs.

Closing costs can quickly become a considerable amount of money including; appraisals, title searches, taxes, etc. Work closely with your realtor to clearly outline and estimate these beforehand.

17. Research Neighborhoods or Areas You Want to Live

There are many variables to think about when researching your future residence. The key to beginning your research is to determine those variables most important to you. Are you looking for a good school district, a large single-family home, a fixer-upper, convenience to commuter options, a specific neighborhood that is extremely friendly and ranks high on Walk Score, or simply any home for sale in Sacramento?

Your real estate agent will likely tell you to figure out your list of the things you want in a house versus the extra features that you would like to have, but wouldn’t necessarily deter you from a house if it wasn’t there.

Your list will help your agent narrow down the number of houses they’ll show you, saving you time by only showing you houses you’d be interested in.

18. Have the Home Appraised

Home appraisals are an important part of the process because oftentimes house prices can quickly skyrocket when the housing market is hot, and banks do not like to loan out more money than what a home is worth. A home appraiser will not only tell you what the home is worth for the area and the current housing market, but this appraisal will also directly affect the size of the loan the bank will give you.

If the home appraisal comes back and states that the house is worth $300,000, but you made an offer of $310,000, the bank will most likely only lend you $300k. You will then either be stuck with paying the additional $10k out of pocket, or you may try to renegotiate the price with the sellers to see if they would be willing to come down. Or you may lose the house altogether.

Also, our mortgage advisers will set up the home appraisal so you can take this time to focus on the next task at hand.

Let us uncomplicated this process!

Get approved, negotiate the best price, and let our expert team technology deliver an uncomplicated closing. Anytime. Anywhere.