Nearly a year after the pandemic brought a wave of lockdowns, travel restrictions, and other sweeping changes to daily life, millennials are eager to purchase homes of their own. Millennials want homes that are both affordable and spacious, especially as we enter an era of remote work and decreased access to public spaces.

But with home prices leaping 8.4% in the past year — and projected to rise an additional 10.5% in 2021 — millennials are facing the reality of skyrocketing demand and vanishing inventory. [1]

Clever’s Annual Millennial Home Buyer Survey, asked 1,000 people who are planning to purchase a home in the next year about their hopes, anxieties, and the compromises they’re willing to make to become homeowners. Comparing this data to previous years to provide a clear snapshot of millennials’ home-buying experience — and the obstacles that may stand in their way. [2]

In a Competitive Market, Millennials Are Willing to Bet on Riskier Homes

Fierce competition for homes may be pushing millennials to expand their house-hunting criteria.

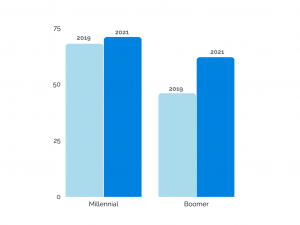

Millennials are undaunted by homes that need major repairs: 71% say they’d be willing to purchase a fixer-upper. Similarly, 62% of boomers are also open to rehabbing a house, a significant leap from the 46% who said the same in 2019.

Would you be willing to buy a fixer-upper?

Although a fixer-upper might seem like a steal, they can be costly to repair and maintain — a major challenge for millennials whose cash reserves are wiped out after purchasing a home. Additionally, those in seller’s markets may be unable to obtain repair credits frol sellers at closing, potentially turning a deal into a money pit.

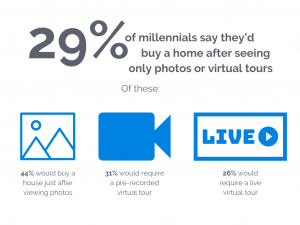

The remaining 6 in 10 millennials don’t necessarily have a hard rule against buying sight unseen — two-thirds of them said they could be convinced to buy a home without seeing it first under some circumstances, including:

- Someone the know can look at the home on their behalf (59%)

- Great price point (51%)

- Newly constructed home or no previous owners (39%)

- Seller concessions, e.g., waived inspection fees, covering closing costs, repair credit, etc. (39%)

- Low interest rates / fear of interest rates rising in the near future (28%)

- High competition from other buyers (21%)

- Inability or unwillingness to travel due to COVID restrictions (14%)

- Disliking current living space (12%)

- Something else (7%)

If millennials are determined to put in an offer on a home sight unseen, they should at least require an inspection contingency. This would allow them to back out if the inspection revealed major issues such as water damage, structural problems, or other costly repairs.

Millennials Want to Take Advantage of Historically Low Interest Rates

Millennials’ willingness to consider riskier properties can be linked to urgency inspired by historically low interest rates.

In December 2020, Freddie Mac announced that fixed-rate mortgages averaged 2.66% — the lowest rate in the survey’s nearly 50-year history. [3]

For 40% of millennials — nearly four times as many compared to last year — low interest rates are the biggest factor motivating them to buy a house.

In fact, low interest rates were the fifth-most-common reason those who don’t like the idea of buying sight unseen might reconsider their stance on the issue.

Although interest rates have begun to tick up again, the Mortgage Bankers Association forecasts that they will likely remain low throughout 2021 — potentially prompting more millennials to buy out of fear that the market will turn. [4]

Between pandemic-mandated remote work and school, millennials feel cramped in their current homes. Approximately one-half cite their need for more space as their biggest motivation for homeownership, up from less than one-third in 2020.

Today, millennials are looking for homes around 2,400 square feet. Though smaller than the ideal boomer home (which is currently around 2,550 square feet), it’s a substantial leap from the approximately 1,700 square feet millennials wanted when we surveyed them before the pandemic broke out last year. [5]

The desire for more space is likely an artifact of having spent so much time in their homes since shelter-in-place and social distance ordinances have been in place.

Millennials are not just looking for bigger homes, though. They are interested in spaces that allow them to work and play at home more comfortably. With more people working remotely during the pandemic, they’re twice as likely to require dedicated office space this year compared to last.

When it comes to non-working hours, millennials want large kitchens, outdoor spaces, and are 33% more likely to desire a pool or hot tub than they were last year.

Among sought-after features, more space is a theme. Millennials are looking for:

-

- A garage (61%)

- Large kitchen (60%)

- Outdoor living space (45%)

- Lots of natural light (44%)

- A basement (43%)

- Space to “grow into” with a family (43%)

- Open floor plan (41%)

- Walk-in master closet (39%)

- Dedicated office space (31%)

- Eco-friendly and energy efficient features such as geothermal heating, solar panels, sustainable materials (27%)

- Pool or hot tub (20%)

- Guest home or mother-in-law suite (17%)

In their search for larger (but still affordable) homes that check off items on their wish lists, nearly 30% of urban-dwelling millennials plan to relocate to the suburbs.

Are you ready to dive in to the next step of your life?

Whether you want small or large, turn-key or a project let’s get you started!

Sources

[1] – https://www.zillow.com/home-values/

[2] – https://listwithclever.com/research/2021-millennial-home-buyer-report/

[5] – https://listwithclever.com/research/2020-millennial-home-buyer-report/