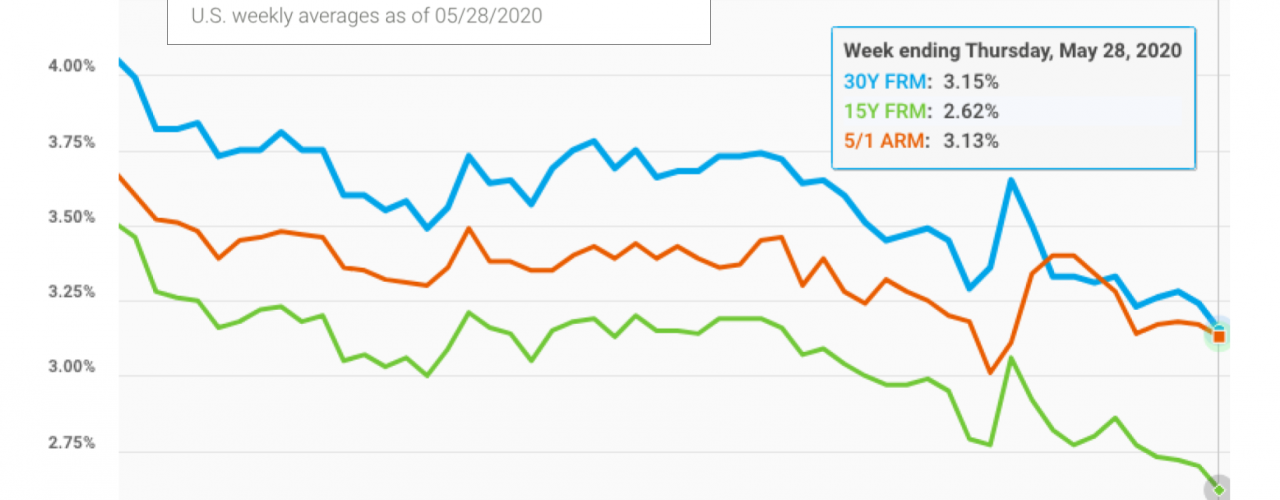

Mortgage Rates Hit Another All-Time Low in May

Mortgage rates continue to bounce at the bottom of the market for 3rd month in a row.

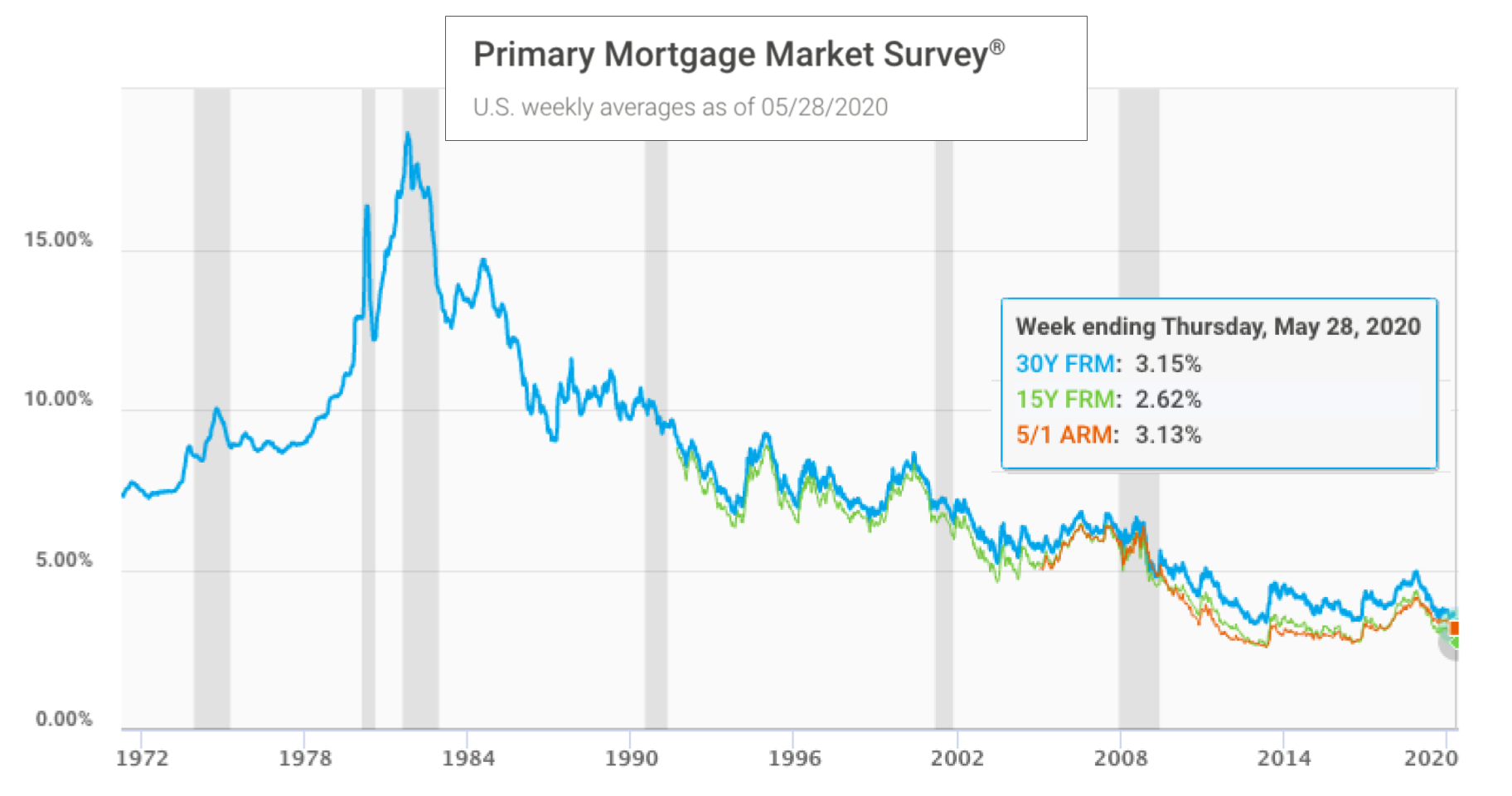

May seems to bring stability and low rates that may not be here to stay. We continue to hover near unprecedented five-decade low rates.

The market continues to give you -home owners and buyers- every possible opportunity to lock a low mortgage rate.

👉 http://getmyrate.snapfi.com

(3 mins – no commitments – no social security number or other personal information needed)

Interest rates are constantly changing and it’s imperative to look at the economy and housing market context. SnapFi reports the rates on the first week of the month from Freddie Mac. The important thing to keep in mind is that even if the rate climbs slightly month to month we need to look at the big picture.

According to Freddie Mac as of May 28, 2020:

“The 30-year fixed-rate mortgage has again hit the lowest level in our survey’s nearly 50-year history, breaking the record for the third time in just the last few months. These unprecedented rates have certainly made an impact as purchase demand rebounded from a 35 percent year-over-year decline in mid-April to an 8 percent increase as of last week—a remarkable turnaround given the sharp contraction in economic activity. Additionally, refinance activity remains elevated and low mortgage rates have been accompanied by a $70,000 decline in the average loan size of refinance borrowers this year. This means a broader base of borrowers are taking advantage of the record low rate environment, which will benefit the economy.”

There are many reasons to refi or lock a purchase rate.

- Purchase a home at the lowest interest rate in 3+ years

- Lower your payment and keep more money in your pocket

- Pay off your mortgage earlier

- Consolidate your debt

- Make a remodel your reality

- Pay college tuition

Takes 3 mins, no need to run credit

snapfi, inc. is licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act NMLS #216565. This is not an offer of credit or commitment to lend. Loans are subject to buyer/property qualification. Rates/fees are subject to change without notice. Total Cash Required may include prepaids/impounds, not cash reserves which may be required for some conventional loans. Total Payment may include taxes, insurance & mortgage insurance.

Source: http://www.freddiemac.com/pmms