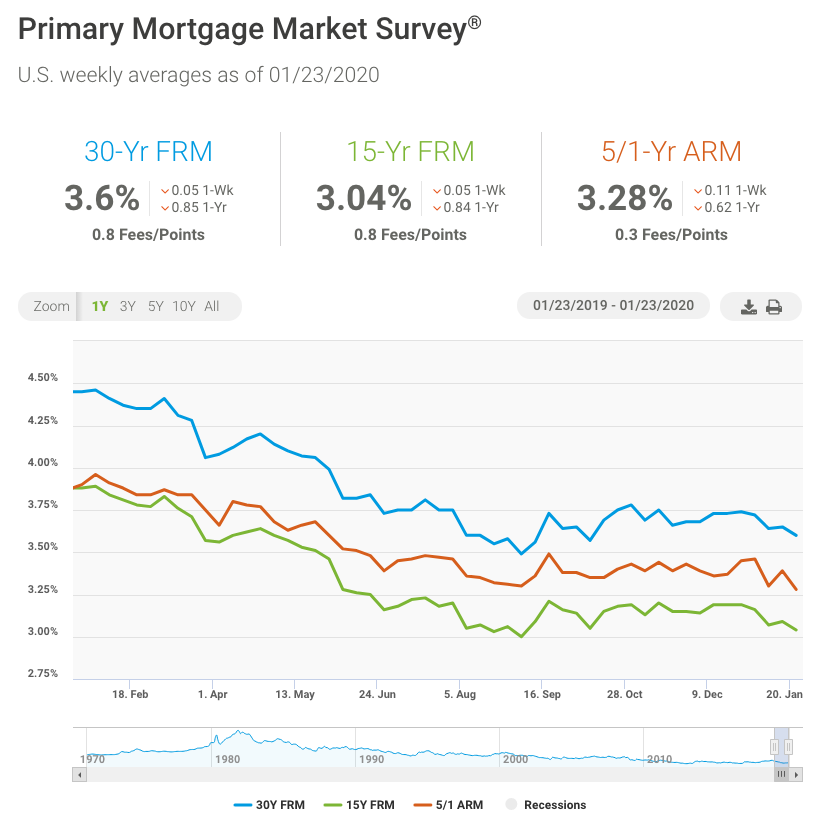

Mortgage Rates Drop to Lowest Level in Three Months!

The market seems to be giving every one multiple chances to lock a low mortgage rate. Interest rates are constantly changing and it’s imperative to look at the economy and housing market context. SnapFi reports the rates on the first week of the month from Freddie Mac. The important thing to keep in mind is that even if the rate climbs slightly month to month we need to look at the big picture. Rates continue to hold steady at the lowest points in the past three years. We know this won’t last much longer…

According to Freddie Mac as of January 2, 2020:

“Rates fell to the lowest level in three months and are about a quarter point above all-time lows. The very low rate environment has clearly had an impact on the housing market as both new construction and home sales have surged in response to the decline in rates, the rebound in the economy and improving financial market sentiment.”

There are many reasons to refi or lock a purchase rate.

- Purchase a home at the lowest interest rate in 3+ years

- Lower your payment and keep more money in your pocket

- Pay off your mortgage earlier

- Consolidate your debt

- Make a remodel your reality

- Pay college tuition

Takes 5 mins, no need to run credit

snapfi, inc. is licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act NMLS #216565. This is not an offer of credit or commitment to lend. Loans are subject to buyer/property qualification. Rates/fees are subject to change without notice. Total Cash Required may include prepaids/impounds, not cash reserves which may be required for some conventional loans. Total Payment may include taxes, insurance & mortgage insurance.

Source: http://www.freddiemac.com/pmms